Can Miner Economics Predict Bitcoin Returns?

The Puell Multiple, miner capitulation and a puzzle worth exploring.

The interactive version of this report can be found here; our previous report on exchange outflows’s predictive power here.

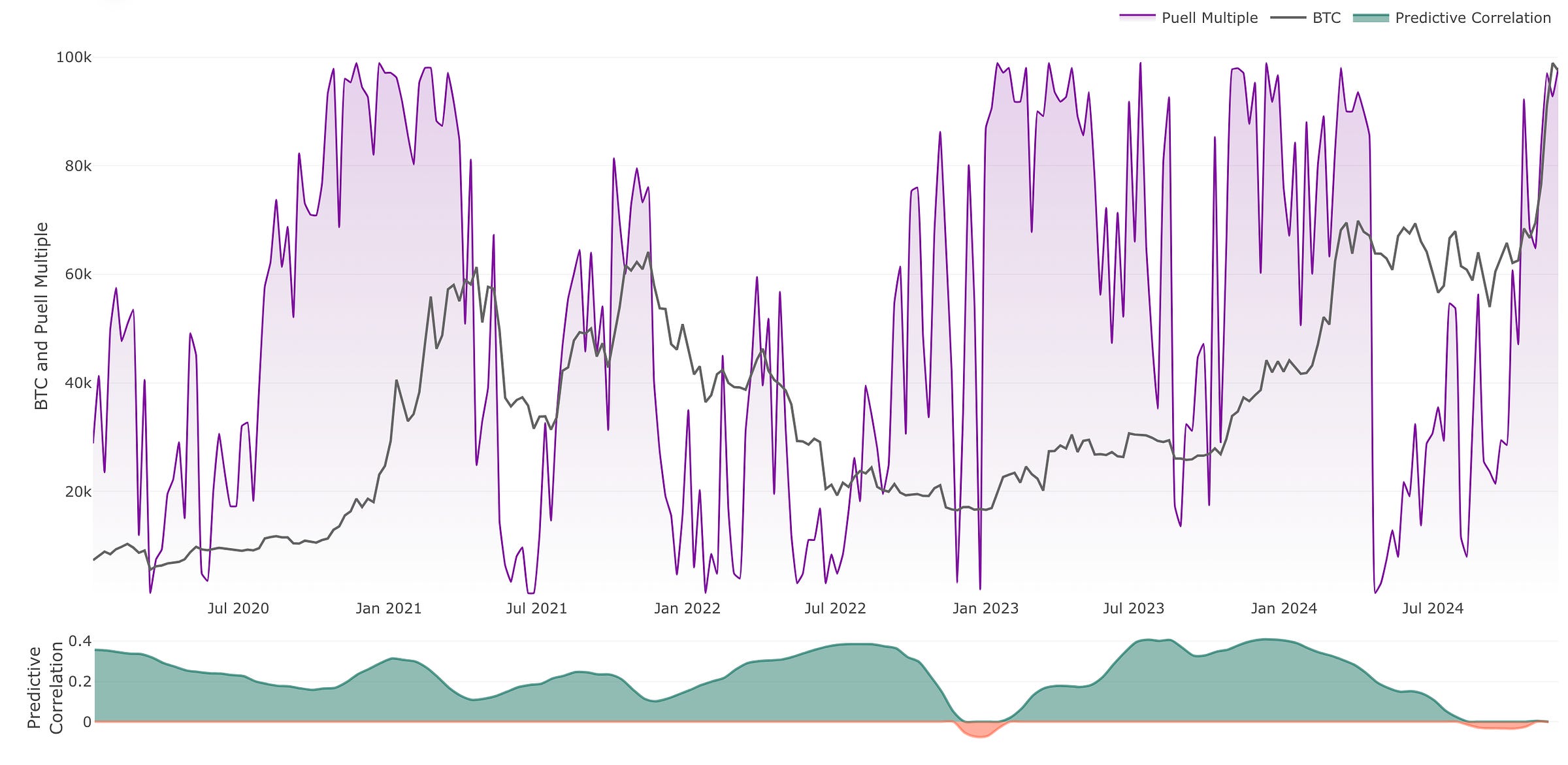

The Puell Multiple was invented by analyst David Puell, back in March 2019. He developed the metric as a way to quantify miner revenue in relation to historical averages: it compares the daily USD value of Bitcoin mined through block rewards to its 365-day moving average, directly meauring whether miners are earning above or below their annual average income.

Unlike price-based technical indicators, it reflects fundamental shifts in Bitcoin’s supply economics through the lens of its most critical stakeholders: miners.

At Unravel, we quantify, analyze and rank the predictive factors that lead crypto markets. Join our growing community of data-driven investors and explore the data on our platform.

Miners operate on razor-thin margins, with costs tied to energy, hardware, and debt obligations. Their need to liquidate holdings to cover expenses makes them “compulsory sellers,” whose actions reverberate through the market:

High Puell Multiple: Indicate miner revenues far exceed their operational costs, often preceding market tops as miners sell reserves to lock in profits, starting to create downward pressure.

Low Puell Multiple: force inefficient miners offline, reducing competition and allowing surviving miners to accumulate at lower costs — historically, a precursor to renewed bullish momentum.

In theory, this dynamic creates a self-reinforcing cycle: miner sell-offs amplify price declines during downturns, while accumulation phases starve the market of supply during recoveries.

At the bottom, we plotted “Predictive Correlation”, the rolling Pearson correlation coefficient between the factor and 90 Day BTC forward returns.

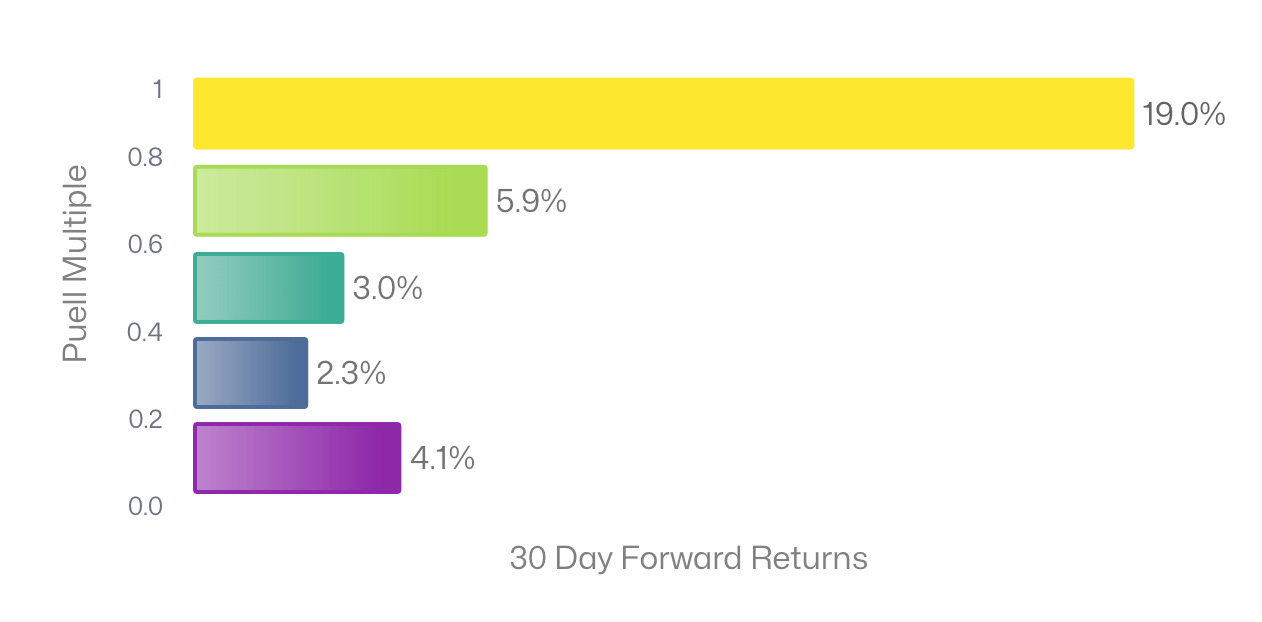

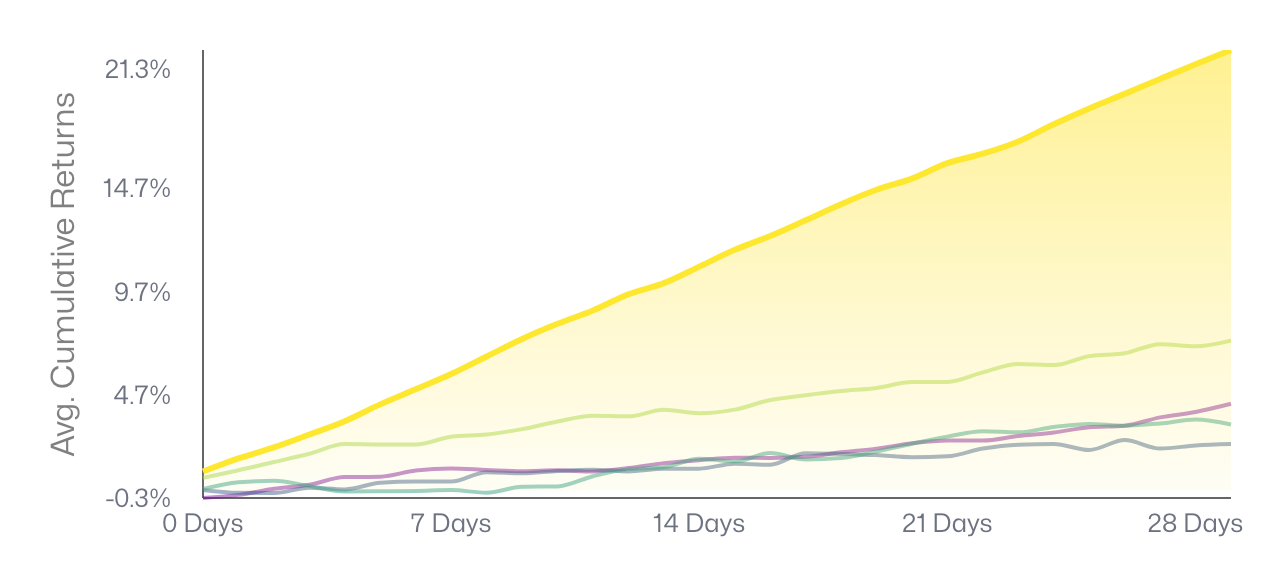

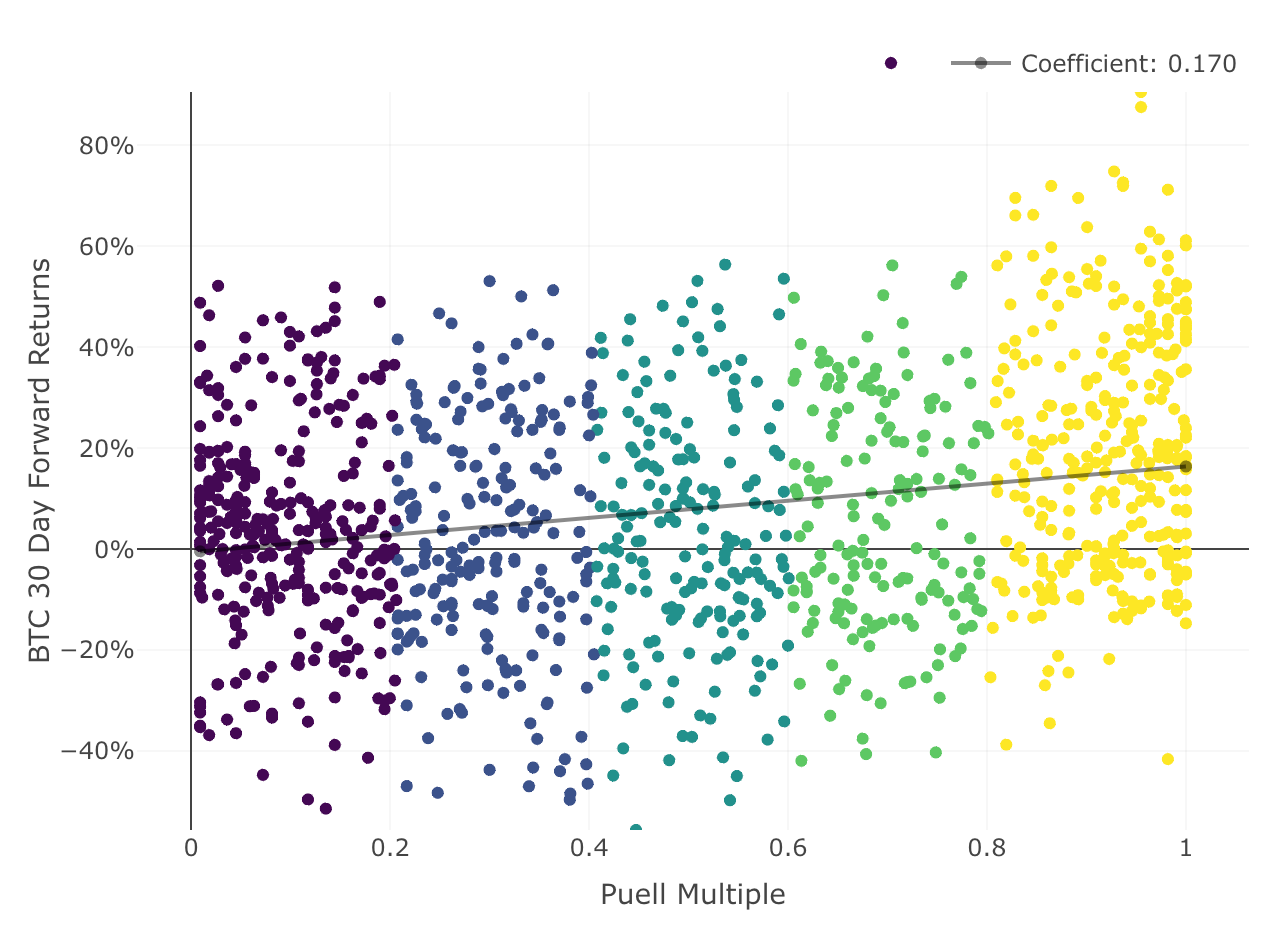

Let’s have a look at what happened to BTC in the next 30 days when the normalized Puell Multiple was low (purple-blue) or high (yellow-green).

The chart shows that high values of the index (yellow, green) led to larger subsequent 30 day BTC returns (blue). Another lens to look at the same data can be found below.

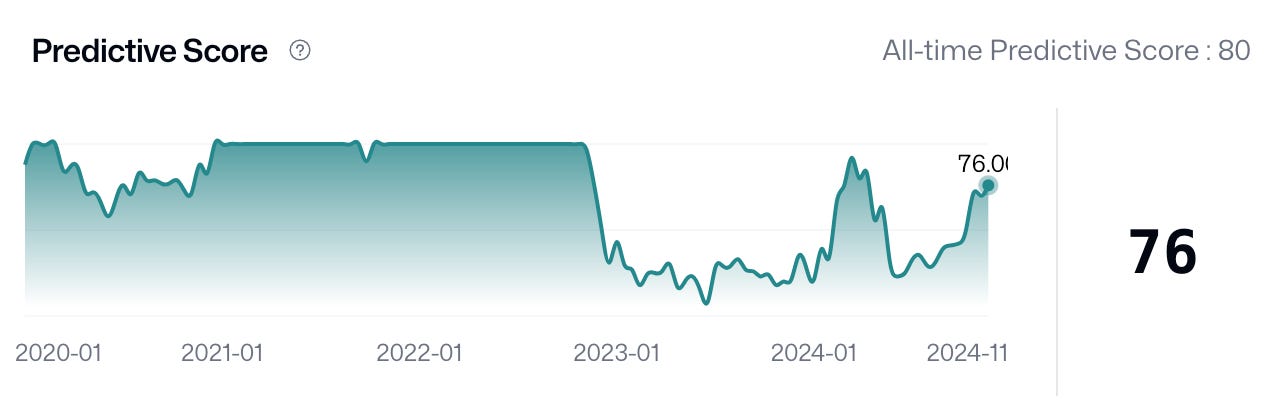

We also developed “Predictive Score”, which measures the ability to successfully translate a leading indicator into a simple quantitative strategy - it is a more actionable measurement of “predictiveness”, appropriate to the noisy environment of financial markets. The motivation behind it is to understand which signals truly matter, and help filter out the noise.

Using it, we can look at how predictive the Puell multiple was historically, and track its effectiveness as a leading indicator over time.

Does it really hold up?

The Puell Multiple’s predictive strength is an interesting puzzle. Periods when mining rewards becoming unsustainable relative to historical norms indicating a further rally may not seem like a causal connection. Why would more miner revenue, manifesting itself in sellable Bitcoin lead to price increases, and isn’t the opposite more plausible?

We don’t have a clear answer — one explanation is that the Puell Multiple is very similar to a simple “Price oscillator”, reflecting market extremes. We’ll explore this in a later article where we group predictive factors based on their correlation, and analyze the ones that are similar.

Nevertheless, while an interesting lens, the Puell Multiple is a model that’s exclusively focused on the internal supply dynamics of Bitcoin, and as institutional players start to dominate trading volumes, miner influence on price may wane in the future, and may become a lot less reliable going forward.

The interactive version of this report can be found here, and our previous report on exchange outflows here.